Executive summary

California’s housing crisis harms nearly every Californian, directly or indirectly. But women bear the heaviest burden from the state’s high cost of housing. Black women, senior women, single mothers, and women living alone are those most likely to be shouldering unaffordable housing costs. Simply being a woman makes one more likely to live in unaffordable housing, even when controlling for race/ethnicity, household income, and employment status.1

The greater difficulty women face in securing affordable housing is deeply intertwined with gender inequality in the broader society. Lower pay, less accumulated wealth, and disproportionate responsibility for taking care of children disadvantages women in the housing market.

Nearly 14 million Californians, including 3.5 million children, live in housing considered unaffordable by standard measures. Roughly 6 million of these people live in owned homes, while roughly 7.8 million live in rentals. While the share of rent burdened Californians increased between 2019 and 2022, it was stable in the most recent year for which data is available (2023). Yet women remain consistently more likely than men to live in unaffordable homes.

Housing is considered unaffordable when more than 30 percent of household income goes toward housing costs, and those spending at this level are designated as “rent burdened”—or “cost burdened” if they are a homeowner. Those who spend more than 50 percent of their income on housing costs are designated as “severely rent burdened” or “severely cost burdened.”

Key Findings

- 53% of women renters live in unaffordable housing, compared to 47% of men renters2

- 62% of Black women are rent burdened; 35% are severely rent burdened3

- 64% of senior women (ages 65+) are rent burdened4

- 70% of women living alone are rent burdened, compared to 61% of their male counterparts5

- 76% of single mothers are rent burdened, compared to 64% of single fathers6

Women More Likely than Men to Live in Unaffordable Housing

California’s home ownership rate is the second lowest in the nation. Roughly four in ten Californians—or about 16 million people—live in rentals.7

Women and men are equally likely to live in rentals, rather than in a home owned by a family member or themselves, but women are significantly more likely than men to be shouldering unaffordable rents.

A sizable majority of women renters (53%) spend over 30 percent of their income on housing. By comparison, fewer than half of men renters (47%) do. Moreover, nearly three in ten women renters (27%) spend over 50 percent of their income on housing. Among those in owned homes, 28 percent of women are cost burdened, compared to 26 percent of men.8

Women disproportionately experience unaffordable housing for four primary reasons. One, women on average enter California’s expensive housing market with lower incomes and less accumulated wealth. Two, women are disproportionately responsible for taking care of children, leaving them with less flexibility about where they can live to be able to balance paid work, commuting to work, and care responsibilities. Three, women are more likely than men to be raising children alone on only one income. Four, women live longer than men; women enter their senior years not only with less retirement savings, but also often end up living alone and shouldering high housing costs on their own. On top of these economic and caregiving inequalities, gender bias and discrimination in the housing market put additional barriers in the way of women’s access to safe, convenient, and affordable housing.9

In sum, the greater difficulty women face in securing affordable housing is deeply intertwined with gender inequality in the broader society. To some degree, all women experience these difficulties. Yet for many women, they are compounded by discrimination and marginalization on the basis of race, age, or other factors; women experiencing additional forms of discrimination tend to be more negatively affected by California’s housing affordability crisis.

Figure 1: Renters living in unaffordable housing, by gender and race/ethnicity

Percentage of California adults living in renting households that are rent burdened or severely rent burdened. Data on Native American, Pacific Islander, Multiracial, and Other Race Californians is insufficient to report. Source: Gender Equity Policy Institute analysis of IPUMS ACS 2023.

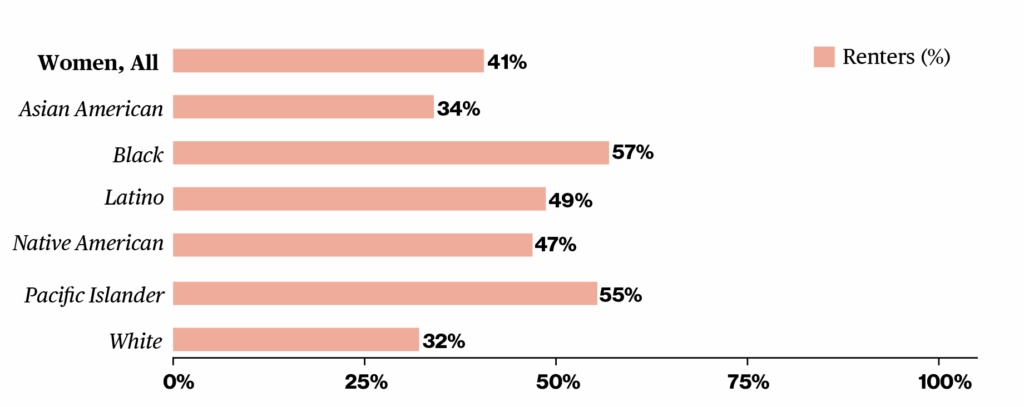

Asian American and White men are the most likely to live in owned homes. When they rent, they have the lowest rent-burden. Likewise, Asian American and White women are more likely than women of all other race/ethnicities to live in owned homes. Among renting women, Asian American women are significantly less likely than White, Black, and Latina women to be rent burdened. Although about two thirds of White women live in owned homes, the minority living in rentals experience high housing costs at a level similar to that of Latina women. (Respectively, 52 percent and 53 percent are rent burdened.)

Figure 2: Share of women renting, by race/ethnicity

Percentage of Californian adult women living in rental housing by race and ethnicity. Source: Gender Equity Policy Institute analysis of ACS 2023.

Black Women Most Disadvantaged in California Housing Market

Within every major race/ethnicity group, women experience significantly higher levels of rent burden than their male counterparts. The gender gap is smallest among Asian Americans, at about 4 percentage points. Black women and men have the largest gap, at 10 points. (There is insufficient data on Pacific Islanders and Native Americans to report statistically reliable differences.)

Black families face the most acute challenge to securing affordable housing. Black women are the most likely to be shouldering high housing costs. Sixty-two percent of Black women renters and 37 percent of homeowners live in unaffordable housing, compared to 53 percent of Latina women renters, for example. One in three Black women renters (35%) spend more than 50 percent of their income on rent, compared to one in four (24%) Californian renters overall. Black women have lower homeownership rates than White, Asian American, or Latina women.

Black men are less burdened by housing costs than Black women. But compared to their male counterparts in other race and ethnic groups, they have the lowest homeownership rate and the highest rent burden. Black men are also significantly more rent burdened than Asian American women.

Latinos face similar levels of rent burden as White Californians, but they account for 46 percent of adults in the state living in unaffordable rentals.

The Intersection of Age and Gender

Women outlive men, and fully 55 percent of Californians ages 65+ are women. While senior women have relatively high rates of homeownership, a disproportionate share of both owners and renters live in unaffordable housing.

Many senior women live alone, and they are significantly more likely than their male counterparts to spend an unaffordable share of their income on housing. Fifty-two percent of senior women homeowners are cost burdened, and 76 percent of renters are rent burdened.

California’s affordable housing crisis takes a toll on children as well. Children who live in homes owned by their parents or guardians fare better, with less than a third living in cost-burdened homes. In contrast, children in renting families are nearly two times as likely as those in owning families to be living in unaffordable housing. All told, more than 2 million California children live in unaffordable rentals, and fully 65 percent of these children are Latino.

Struggling on One Income: Single Mothers and Women Living Alone

Even two-income families can struggle to afford housing in California. Covering housing costs is even more difficult for people living alone or raising a family alone. Still, the pattern of women being disproportionately rent and cost burdened compared to men holds among these households. The only homeowners with cost burdens above 50 percent are single mothers and women who live alone. Among women renters living alone, 70 percent pay unaffordable rents, compared to 61 percent of their male counterparts. For reference, rent burden for those in couple-led families is only 45 percent.10

Single parents are highly likely to be renters and they experience some of the highest levels of rent burden in the state. The gender gap in rent burden between single mothers and fathers is stark. At 12 percentage points, it is wider than any of the gender gaps within race/ethnicity groups. Mothers head about eight in ten single-parent families in California.

Roughly 2.2 million adults and children live in single mother families. These families are the least likely to own their homes. Rent burden is extremely high among the seven in ten single mothers who rent. More than three-quarters (76%) are rent burdened and about half (48%) are severely rent burdened, paying over 50 percent of their income on rent.11

Recommendations

Women confront unique challenges to securing affordable and suitable housing in California. To address gender and racial disparities in housing affordability and lay the groundwork for an effective and equitable solution to California’s housing crisis, the following policies should be considered:

- Dedicate increased state investment to housing.

- Incentivize the production of multifamily housing, particularly in urban areas and other population centers and job hubs.

- Reduce the cost and time required for building new housing through permitting reform.

- Preserve and renovate existing affordable housing.

- Integrate a gender equality perspective in housing policy.

- Direct housing assistance to single parents, seniors living alone, and people at the lowest income levels.

- Incentivize the incorporation of gender-responsive design principles in new housing development.

- Enhance state and local agencies’ capacity to collect and analyze gender-disaggregated data.

In previous reports on California’s housing crisis, Gender Equity Policy Institute has documented best practices for gender-responsive housing policy and provided case studies from around the world. Those reports can be found at the embedded links or on our website under the ‘Housing’ tag at: https://thegepi.org/publications. Future reports in our Housing series will explore the policy landscape in more detail.

Methodology

Gender Equity Policy Institute analyzed U.S. Census, American Community Survey (ACS) 2023 household and individual level data accessed through IPUMS USA, University of Minnesota, www.ipums.org. For analysis of affordability over time, we drew on our analysis of 2019-2022, as presented in previous reports.

Data was collected and analyzed at both the household and individual level. All analyses were stratified by gender and race/ethnicity. ACS identifies twelve categories of households, which we categorized into three main groups: married or cohabiting households (couple-led households), women headed households, and men headed households. We also analyzed data using disaggregated household types, such as single parents, individuals living alone, and individuals with roommates. People living alone are grouped according to the gender identification of the individual. Most of the findings herein are reported at the individual level, as the household level captures only the gender and race/ethnicity of the household head.

We assessed housing affordability for renters and owners using the conventional measure of housing cost burden: the number and proportion of Californian adults and children, by gender and race, living in households spending more than 30% (rent or cost burdened) or more than 50% (severely rent or cost burdened) of household income on housing.

About Gender Equity Policy Institute

Recommended Citation

“A Gender Equality Perspective on California’s Housing Crisis,” Gender Equity Policy Institute, June 2025.

Contact Information

For media inquiries, email: [email protected] | [email protected]

To reach the authors, email: [email protected]

Statement of Research Independence

Gender Equity Policy Institute is a nonpartisan 501c3 organization. The Institute conducts independent, empirical, objective research that is guided by best practices in social science research. The Institute solicits and accepts funding only for activities that are consistent with our mission. No funder shall determine research findings, conclusions, or recommendations made by the Institute. Gender Equity Policy Institute retains rights in intellectual property produced during and after the funding period. We provide funders with reproduction and distribution rights for reports they have funded. Gender Equity Policy Institute is solely responsible for the content of this report.