The high cost of rental housing in California falls heaviest on women, especially Black women, single mothers, and older women living alone.

“Women and Housing in California, 2024”, the third in Gender Equity Policy Institute’s series on gender and housing in California, examines housing cost disparities among California’s renters and renting families.

Comparison with previous years confirms that the COVID-19 pandemic put enormous strain on renters in California. At the end of the second year of the pandemic (2021), a larger share of every demographic group was burdened with unaffordable rental costs, compared to the pre-pandemic year 2019. That remained the case as the pandemic eased and the state economy boomed in 2022.

Data in this brief is drawn from the U.S. Census, American Community Survey, 2022—the most recent year for which the Census Bureau has released full relevant data. It is important to note that at the time this data was collected, most of the recent state legislation designed to ease California’s affordable housing crisis had not yet been implemented.

Key Findings on Renters and Renting Families

- 53% of women living in rentals spend an unaffordable share of income on housing, compared to 48% of men

- Nearly 3 in 10 women living in rentals spend over half their income on rent

- 77% of single mother renters pay unaffordable rents

- 36% of Black women living in rentals spend over half their income on rent

- 75% of older women renters who live alone pay unaffordable rents

- Latina women are nearly 8 times as likely as White women to live in severely overcrowded homes

Women are more likely than men to be struggling to afford housing

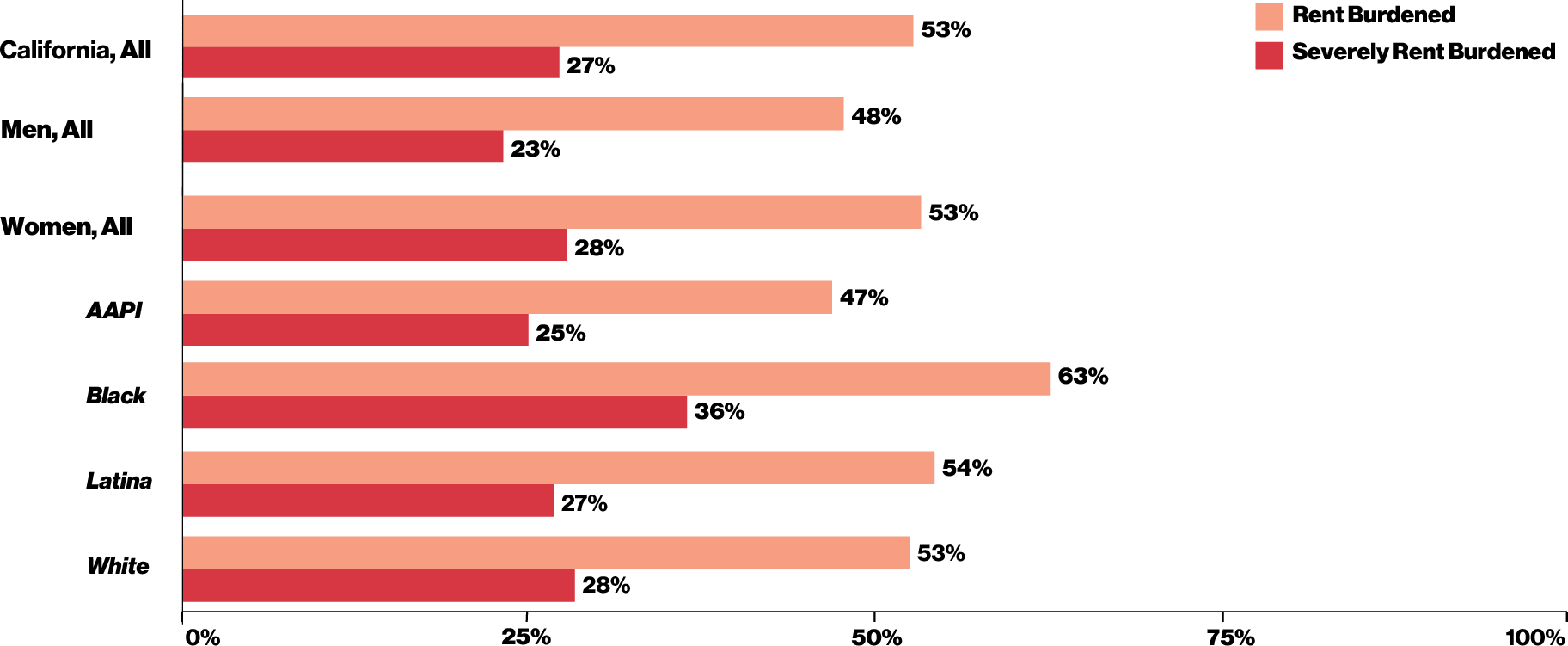

Women and men are equally likely to live in rentals rather than homes owned by family members, but women are more likely than men to face unaffordable rental costs. A sizable majority of women living in rented homes spend more than 30% of their income on housing costs—a level considered unaffordable and defined as “rent burdened” under standard measures.

Even more concerning, nearly three in ten women spend over 50% of their income on rent, a level defined as “severely rent burdened” under standard measures. By comparison, 48% of men are rent burdened and 23% are severely rent burdened. About 3.1 million women in California live in rent burdened households. Of these, approximately 1.6 million live in rentals spending more half their income on housing costs.

Nearly one in three people in the state live in a household headed by a woman. Two-thirds of these renting women-led households (68%) are rent burdened. They are 41% more likely to be rent burdened than renting households headed by a married or cohabiting couple.

From 2019-2022, rent burden increased for all groups of women. In every major race/ethnicity group, there is a gender gap in rent burden, with women experiencing higher rates than their male counterparts, ranging from 3 to 6 percentage points.

Another revealing indicator of how California’s housing affordability crisis disproportionately impacts women comes from the federal government’s measure to allocate housing assistance: the local area median income (AMI). Women are more likely than men to live in extremely low-income households—those earning less than 30% of AMI. Roughly a quarter of women-led households have extremely low-income.

More than 3 million women in California live in unaffordable rental housing

Rent burden among people living in rentals, by gender and race/ethnicity: Housing is considered unaffordable when more than 30% of household income is spent on housing costs. Renter households at this level are defined as “rent burdened.” Those spending more than 50% of their household income are defined as “severely rent burdened.”

Rent burden among people living in rentals, by gender and race/ethnicity: Source: GEPI analysis of the 2022 American Community Survey.

Women are disproportionately burdened with high housing costs for three primary reasons. One, women enter the housing market with lower incomes and less accumulated wealth. Two, women are more likely than men to be heading a household or family on only one income. Three, gender bias and discrimination in housing and in the broader society place additional obstacles in the way of women’s access to housing that is safe, convenient, and affordable. In short, the greater difficulty women face in securing affordable housing is deeply intertwined with systemic gender inequality.

Most women, to some degree, face these obstacles. Yet women who experience intersecting forms of marginalization or discrimination, whether on the basis of race or ethnicity, disability, age, or other factors, tend to be more negatively impacted and suffer disproportionate harms from California’s housing affordability crisis.

Nearly two-thirds (63%) of Black women living in rentals are rent burdened and 36% are severely rent burdened. Likewise, Black Californians are the least likely to live in homes owned by a family member. Compared to other race/ethnicity groups, Black women and children are the most likely to be living in rental homes spending more than half of household income on housing costs. Black men are also disproportionately impacted by housing costs. They have the highest rate of rent burden among men, at 56%, as well as a higher level than that of Latina, White, and Asian American Pacific Islander (AAPI) women.

Some of the affordability challenges Latinas face are largely shared with Latino men, as two-thirds live in households led by a couple. Latino couple-led households have the highest rent burden among their counterparts, with 51% rent burdened. By comparison, 39% of White couple-led households are rent burdened. But the gender gap between Latinos in rent burden is one of the largest, at 6 percentage points. A sizable majority of Latina women (54%) are rent burdened, compared 48% of Latino men.

A majority of White women (53%) are rent burdened. While this is about the same level of rent burden as that experienced by Latinas, Latinas are nearly 8 times as likely as White women to live in severely overcrowded homes.

AAPI women are the most financially secure among women renters in California, with less than half (47%) rent burdened and a quarter (25%) severely rent burdened.

Single mothers and women 65 and older have the highest levels of rent burden in California

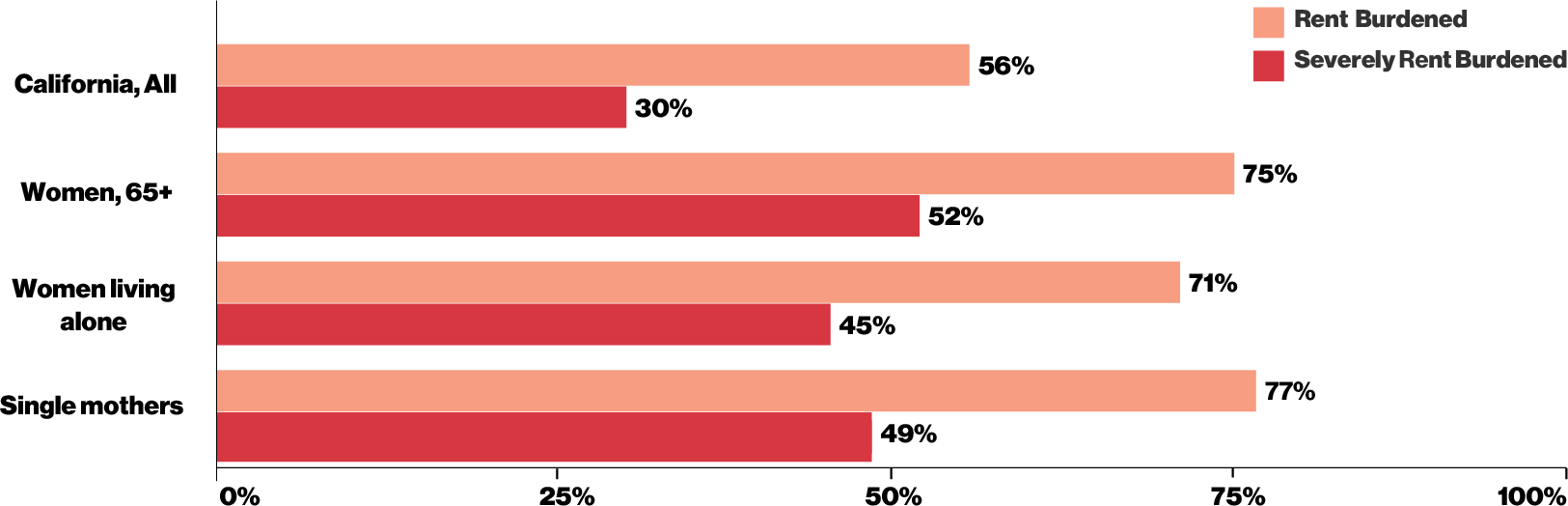

Rent burden among older women, women living alone, and single mothers living in rentals.

Source: GEPI analysis of the 2022 American Community Survey.

Being able to afford housing in California can be difficult on two incomes. Managing on one income is even more challenging. Women are more likely than men to be raising children alone. More than 2.2 million Californian women and children live in households led by single mothers. More women than men live alone. About 1.8 million women in California live alone, compared to 1.5 million men who do so.

Approximately half of women living alone (877,000) are 65 and older. Women make up 55% of Californians 65 and older and 58% of those 75 and older; their numbers are increasing even as California loses population to other states. Older women have a comparatively high rate of homeownership. Still, one third (34%) are renters, and these older women renters experience the second highest level of rent burden in the state. Seventy-five percent are rent burdened and 52% are severely rent burdened.

Ultimately, single mothers experience the most acute housing challenges in California. They have the lowest rate of home ownership (28%) in the state. Among single mothers who rent, 77% are rent burdened. One in every two renting single mothers spends more than 50% of her income on housing. Single mother households are 4.6 times as likely as couple-led household to be extremely low income under local area median income thresholds. Latinos are disproportionately impacted by the difficulties faced by this group. More than half of California’s single mothers are Latina and nearly 6 in 10 children living with a single mother are Latino.

Methodology

The Gender Equity Policy Institute analyzed U.S. Census, American Community Survey (ACS) 2022 household and individual level data accessed through IPUMS USA, University of Minnesota, www.ipums.org. For analysis of affordability over time, we also conducted an analysis of ACS 2021 data and drew on our analysis of ACS 2019 data, as presented in “Gender & Housing in California: An Analysis of the Gender Impacts of California’s Housing Affordability Crisis,” Gender Equity Policy Institute, August 2022. https://doi.org/10.5281/zenodo.6941631

Data was collected and analyzed at both the household and individual level. All analyses were stratified by gender and race/ethnicity. ACS identifies twelve categories of households, which we categorized into three main groups: married or cohabiting households (couple-led households), women headed households, and men headed households. We also analyzed data using disaggregated household types, such as single parents, individuals living alone, and individuals with roommates. Households with unrelated adults living together are distinct from couple-led households and are grouped, as the data indicates, as women-headed or men-headed households. Individuals living alone are grouped according to the gender identification of the individual.

We assessed housing affordability for renters using two different measures: 1) the number and proportion of Californian adults and children, by gender and race, living in rentals in which the household is spending above 30% (rent burdened) or above 50% (severely rent burdened) of its income on housing; and 2) the proportion of California households with income at or below the local area median income (AMI).

To analyze household income relative to local area median income (AMI), we defined income limits according to the thresholds set by the U.S. Department of Housing and Urban Development (HUD): acutely low income, extremely low income, very low income, lower income, moderate income, and above area median income. To be able to analyze the number of households in each income category, as well as disaggregate these findings by gender and race, we calculated the median household income for every county using ACS (2022) data. These county median incomes differ somewhat from HUD’s levels and our estimates do not necessarily reflect eligibility for federal housing assistance.

Citation

Gender Equity Policy Institute, “Data Brief: Women and Housing in California, 2024,” March 7, 2024.

About Gender Equity Policy

Gender Equity Policy Institute is a nonprofit nonpartisan research organization dedicated to advancing opportunity, fairness, and well-being for all people through research and education exposing the gender impacts of the policies, processes, and practices of government and business.

Contact

For media inquiries, email: [email protected]

To reach the authors, email: [email protected]